Outward Delivery Challan is a document to inform the Sales authorities on what items have been transported and to whom etc. Sometime it can be combined with Invoice too. Post GST, its essential to send the e-Way bill along with the Delivery Challan

Most of the manufacturing companies outsource their work to Subcontractors / Job worker for the work to complete. These subcontractors or Job Workers receive the material from “Principle Manufacturers” and process and send it back to them. Here the material is still owned by the Principle and Job worker can charge his service fees to him. The basic business needs is to identify what items are sent and what exactly the work to be done. ACTouch Cloud-ERP Sytem helps you to manage the stocks that are sent to Subcontractor and track what materials have come back etc.

A Delivery Challan is a document that includes a list of dispatched items, the time of supply, the quantity dispatched, and the details of the vehicle. It can be converted into a GST invoice to take Input Tax Credit after the items are delivered.

In few Cases DC needs a e-way bill , if the DC amount is more than a pre-set amount. Few business work with an idea of Tax I nvoice cum delivery challan model and here too, you need an e-way bill to be generated.

Delivery Challan formats are different based on whether its an inward delivery challan or Outward delivery challans. This is again changes based on Is it Subcontracting work or Customer Job work.

GST has come with basic rules for the Manufacturer to receive the materials within a period else it is to be treated as Sales.

In case, these materials have not received back in the specified time, then GST expects the manufacturer to issue an invoice as this is treated as Sales.

Want to know more about ERP Features and our Services?

Many manufacturers send the Jigs and fixtures or Molds & Dies to execute the work at the Job Worker. The assumption here is these are sent with a returnable DC and these are not going to change their form. So GST doesn’t consider this for any taxes etc and no timeline is applied.

Every items that’s sent to Job worker should contain the details of items sent, the despatch time and Quantity time. It’s a good practice to mention what for these are sent. It can also contain delivery vehicle details. This document is issued by Manufacturer and these are part of the GSTR returns too. Please note that Government of India has not specifically said about the format etc. but they are clear with the minimum data it should contain. So you may add more details, if required. The challan issued must include the following particulars:

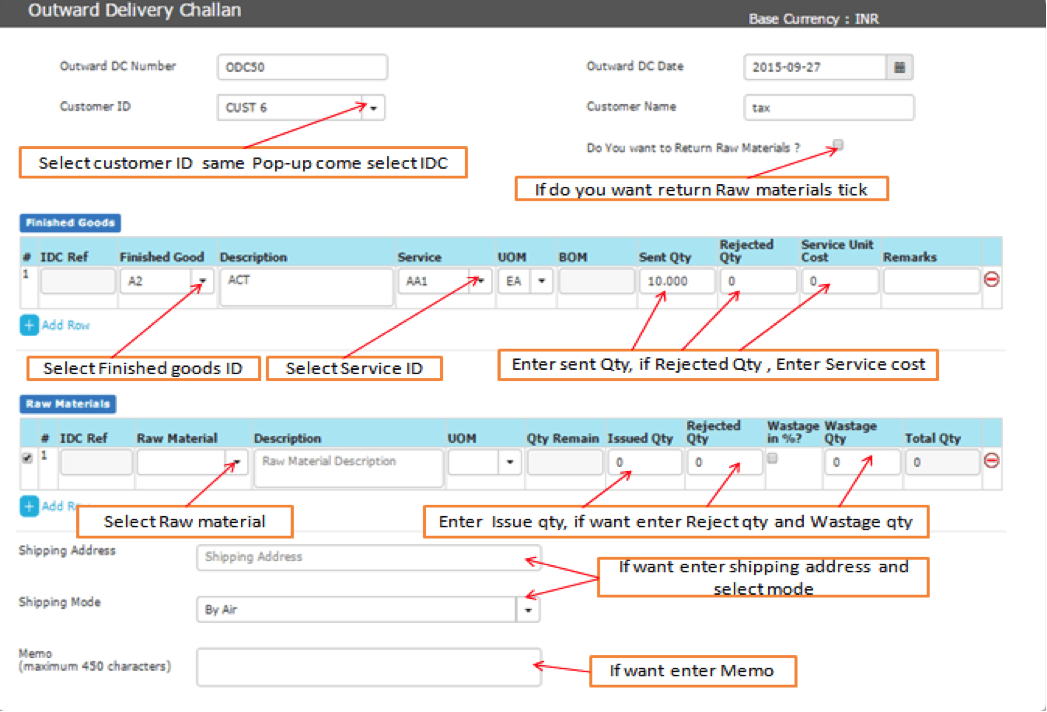

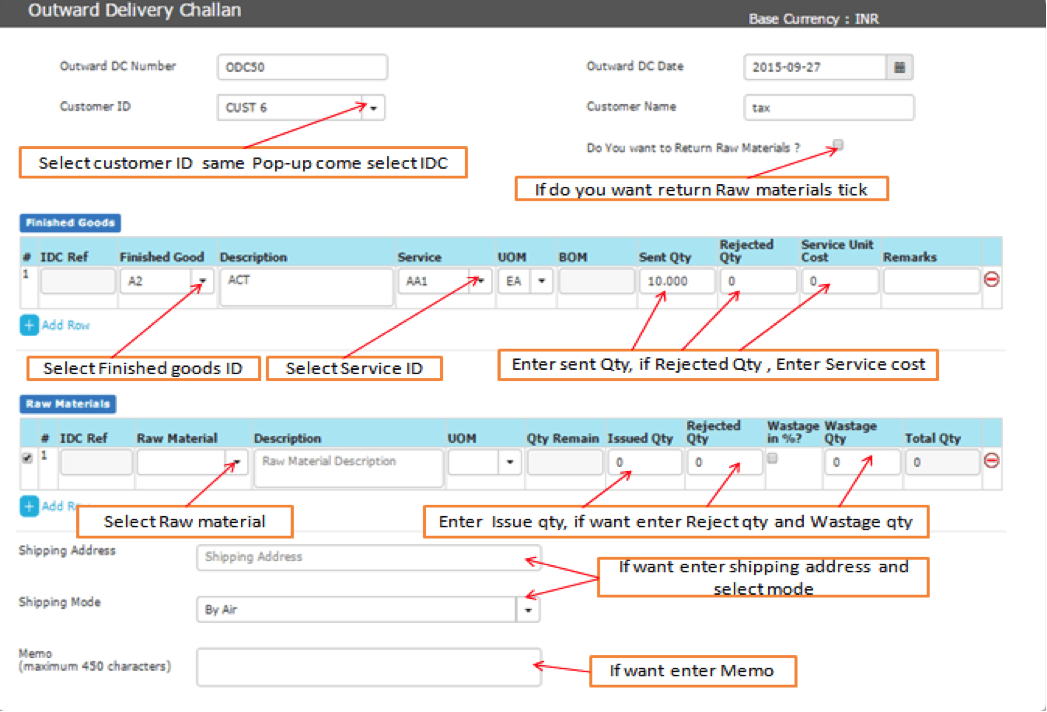

You can use this menu to send the Finished goods to Customer post the work is done. This helps to track the Finished Goods sent to Customer and on which date etc. Now with ACTouch.com, you make a “Job Work Outward delivery challan” easily.

In the business, Customer will send his raw materials to his subcontractor to do the activities thats not done within his factory. It could be for Assembly, Conversion of RM to Semi Finished Goods etc. So he will send a “Job work outward delivery challan” listing the items that are sent to him. While making an Job work Outward Delivery Challan, we choose an Inward Delivery Challan against which the FG is sent. Screen is evident with details to be entered and managed.

You have an option to enter the details of e-way Bill as per the needs.